Minnesota paycheck calculator

Unlike the Federal Income Tax Michigans state income tax does not provide couples filing jointly with expanded income tax brackets. Payroll check calculator is updated for payroll year 2022 and new W4.

Minnesota Sales Tax Guide And Calculator 2022 Taxjar

Calculate your Minnesota net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Minnesota paycheck calculator.

. Minnesota has a total of 225454 businesses that received Paycheck Protection Program PPP loans from the Small Business Administration. Each filer type has different progressive tax rates. Need help calculating paychecks.

Switch to Minnesota hourly calculator. Michigans maximum marginal income tax rate is the 1st highest in the United States ranking directly below Michigans. Alabama has a total of 169672 businesses that received Paycheck Protection Program PPP loans from the Small Business Administration.

To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. There is no state-level payroll tax. Overview of Federal Taxes When your employer calculates your take-home pay they will withhold money for federal and state income taxes and two federal programs.

Federal Paycheck Calculator Calculate your take home pay after federal state local taxes Updated for 2022 tax year on Aug 02 2022. We developed a living wage calculator to estimate the cost of living in. This table shows the top 5 industries in Alabama by number of loans awarded with average loan amounts and number of jobs reported.

Texas Hourly Paycheck and Payroll Calculator. Well do the math for youall you need to do is enter the applicable information on salary federal and state W-4s deductions and. Free Federal and Minnesota Paycheck Withholding Calculator.

Michigan collects a state income tax at a maximum marginal tax rate of spread across tax brackets. Instead you fill out Steps 2 3 and 4. 2022 W-4 Help for Sections 2 3 and 4 Latest W-4 has a filing status line but no allowance line.

Oregon Paycheck Calculator Calculate your take home pay after federal Oregon taxes Updated for 2022 tax year on Aug 02 2022. Calculating paychecks and need some help. Salary Paycheck and Payroll Calculator.

If your monthly paycheck is 6000 372 goes to Social Security and 87 goes to Medicare leaving you with 6000 372 87 5541. Tax liability All deductions Withholdings Your annual paycheck State payroll tax. 2021 Minnesota Allowance Worksheet A.

Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees. Families and individuals working in low-wage jobs make insufficient income to meet minimum standards given the local cost of living. This number is the gross pay per pay period.

Choose Tax Year and State. The PaycheckCity salary calculator will do the calculating for you. Refer to Tax.

It will calculate net paycheck amount that an employee will receive based on the total pay gross payroll amount and employees W4 filing conditions such us marital status payroll frequency of pay payroll period number of dependents or federal and state exemptions. Paycheck Manager offers both a Free Payroll Calculator and full featured Paycheck Manager for your Online Payroll Preparation and Processing needs. Dont want to calculate this by hand.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Texas. Subtract any deductions and payroll taxes from the gross pay to get net pay. The tool below can be used to search all publicly released PPP recipients.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and well crunch the numbers. This table shows the top 5 industries in Minnesota by number of loans awarded with average loan amounts and number of jobs reported.

What is the living wage calculator.

Timeline For Property Taxes Carver County Mn

Paycheck Tax Withholding Calculator For W 4 Tax Planning

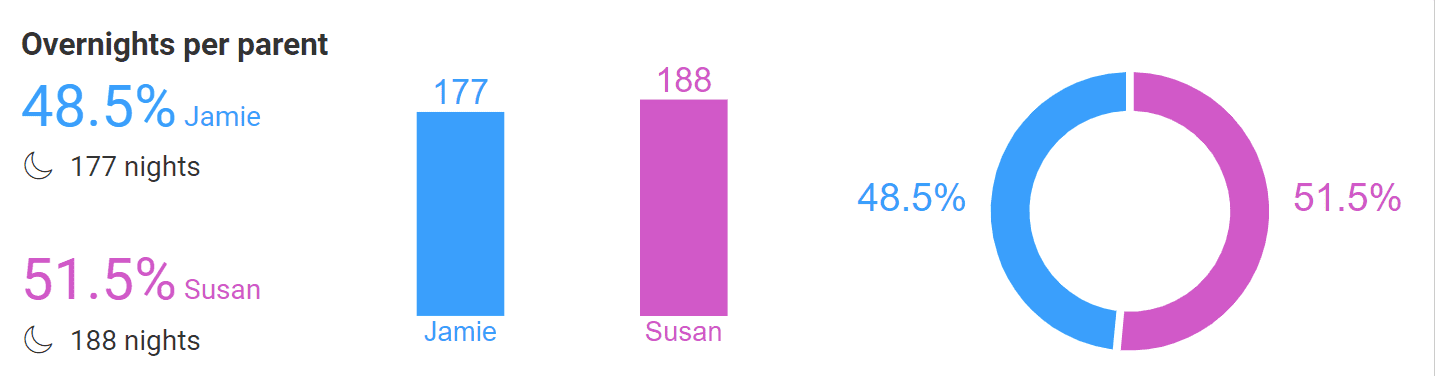

The Easiest Minnesota Child Support Calculator Instant

Minnesota Paycheck Calculator Smartasset

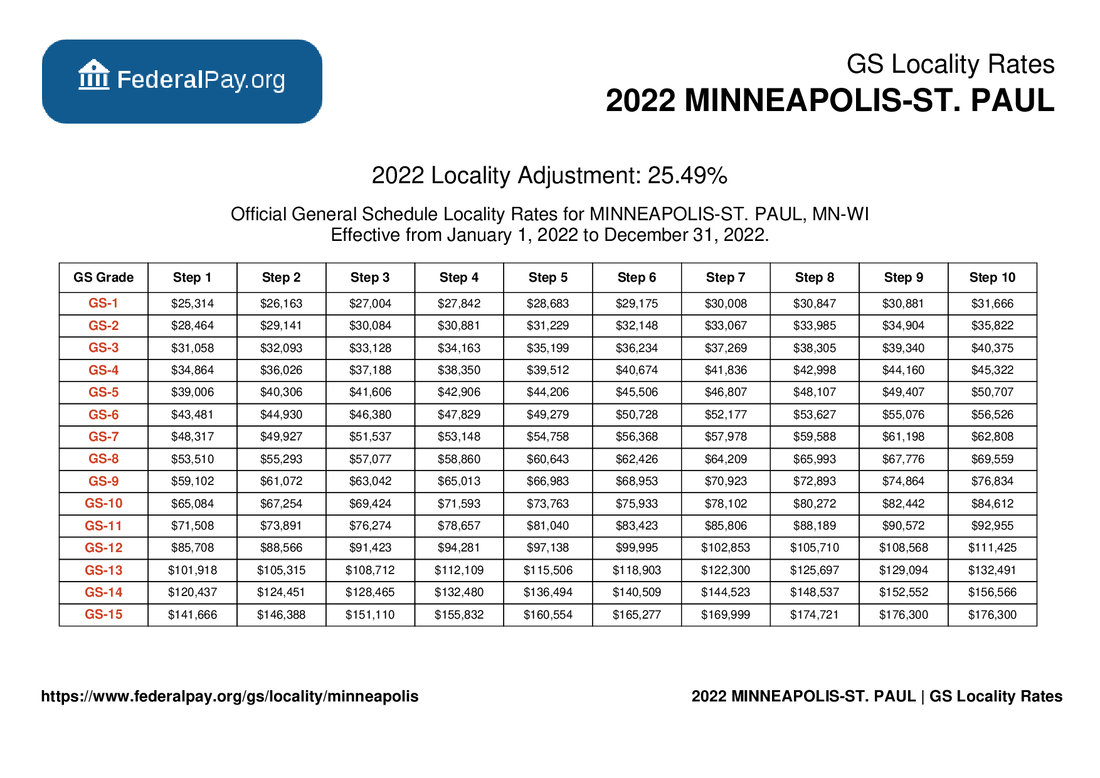

Minneapolis Pay Locality General Schedule Pay Areas

Raising Minnesota S License Tab Fees Could Be A Key Component Of Any Transportation Deal Here S How It Would Work And Who Would Pay Minnpost

Salary Paycheck Calculator How Do You Calculate Your Take Home Pay Marca

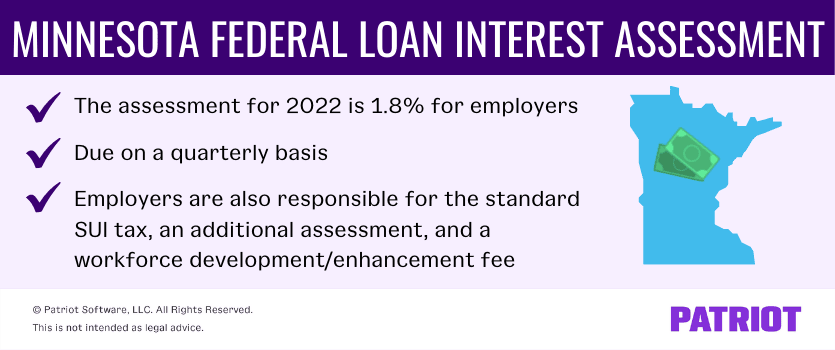

Minnesota Federal Loan Interest Assessment How To Calculate

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Minnesota Last Paycheck Lawsuit Final Paycheck Laws In Minnesota

Minnesota Paycheck Calculator Smartasset

Hennepin County Mn Property Tax Calculator Smartasset

Minnesota Federal Loan Interest Assessment How To Calculate

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Minnesota Retirement Tax Friendliness Smartasset

Payroll Tax Calculator For Employers Gusto

Minnesota Income Tax Calculator Smartasset